The brand new FHA mortgage ‘s the oldest and most well-recognized low down payment financial having first-time home buyers. It is the connect-all choice for customers that simply don’t see other reasonable without downpayment mortgage requirements.

And, FHA finance are assumable, and therefore whenever a purchaser carries their home, this new manager can use a similar FHA mortgage on exact same home loan interest rate.

Because of the FHA, You.S. houses stabilized of the later-1930s. Nine age later, the fresh FHA’s leading real estate loan have helped 10s regarding many Us americans get its very first domestic. Almost one in 5 earliest-big date customers play with FHA resource.

Up until the FHA, really the only location for earliest-big date homebuyers to find a mortgage is its local neighborhood financial.

While the banking companies was scared and then make lenders and you can property are built-in to the recovery, the us government introduced the FHA since an insurance coverage department to possess finance companies. As long as a resident as well as home loan fulfilled the fresh new government’s specified requirements, the newest FHA wanted to pay the financial institution is to a homeowner default on the its money.

Having FHA home loan insurance rates available, banking institutions already been and work out money so you can very first-day consumers once again, and you may property added the nation out-of Depression.

FHA-supported mortgage loans utilize the same financial deal just like the most other U.S. lenders. Customers borrow funds, agree to monthly installments, and you can repay the loan in their assortment of fifteen or 30 years.

There isn’t any punishment to have offering your property before financing gets repaid, and you will, due to the fact homeowner, customers keep up with the straight to pay its mortgage off less otherwise re-finance they.

FHA fund wanted you to definitely people make a down-payment out-of at the least step three.5 % from the purchase price, otherwise $step three,500 per $100,100. There’s no limit downpayment count.

Centered on financial application providers Ice, the average FHA domestic consumer makes a downpayment out of less than simply 5 percent.

FHA fund need most customers provides a credit history from 580 or more, however, consumers that have results as little as five-hundred meet the criteria having a down payment out of 10 percent or higher.

So you’re able to qualify for an FHA mortgage, homebuyers and also the domestic it get need certainly to meet with the FHA’s qualification conditions, summarized right here:

The FHA does not demand a minimum credit rating because of its mortgage system and renders unique provisions for consumers no credit rating or credit history. The newest FHA sends lenders to seem beyond somebody’s credit rating and get the new bigger picture. Find out about the credit score had a need to buy a house.

There are no unique qualification conditions associated with FHA mortgage program. Homebuyers normally inhabit people property in just about any You.S. city.

Customers don’t require societal safeguards amounts, both. Non-long lasting resident aliens can use FHA mortgage loans, as well as personnel of the world Lender and you may international embassies.

FHA mortgage guidance was less rigid than other authorities-backed mortgage programs. If you’ve gotten turned-down to own a conventional financial or Va loan, FHA money may help you end renting and commence purchasing.

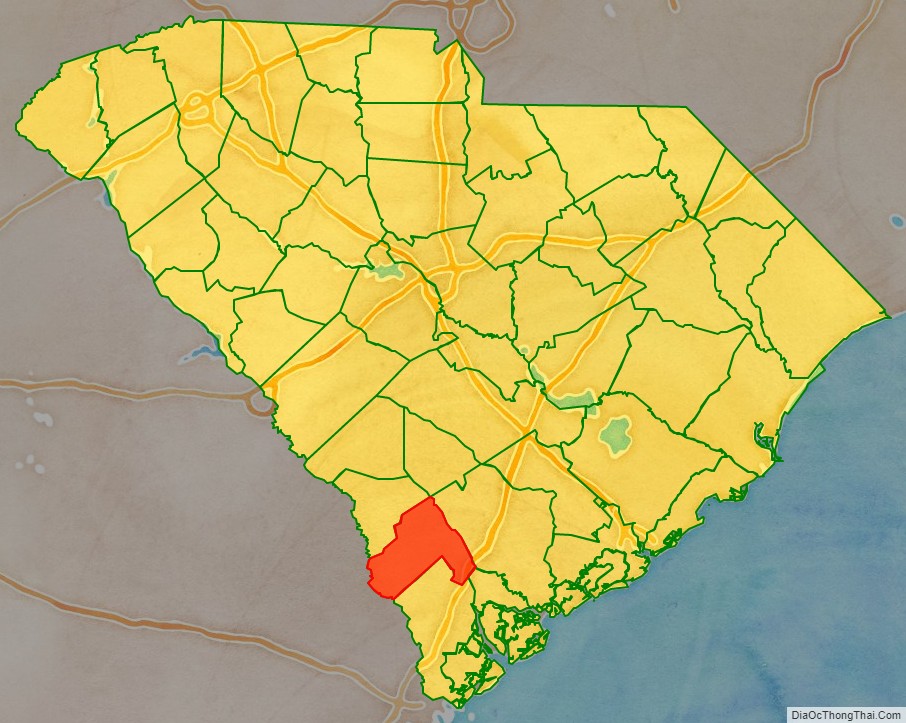

The latest FHA simply provides mortgages from certain items. The higher restrictions are very different because of the part. This new constraints are commonly known as the FHA loan restrictions. This new Federal Housing Financing Agency (FHFA) condition loan constraints per year.

New FHA provides a loan maximum table which can be used to check the most allowable loan size on your county.

Across the country, the brand new next page 2022 FHA loan restrict was $420,680. When you look at the areas where the expense of lifestyle exceeds regular eg Bay area otherwise Brooklyn FHA mortgage restrictions try increased so you can of up to $970,800.

"Sky Tour" company has successfully been working in the tourist market of Tajikistan since February 2011. Despite a relatively short period of activity, the company has thousands of organized trips and satisfied customers. We provide a wide range of tourist services, from excursions around Tajikistan, to round-the-world travel. We organize travel for every taste and depending on the wishes, we select the most ideal variant for the tourist. Managers of the company "Sky Tour" are highly qualified professionals, experts in their work and work execution is impeccable. We track every stage of the journey of our tourists and in the event of unforeseen situations we quickly resolve the issues that have arisen. "Sky Tour" company successfully cooperates with tour companies in all regions of Tajikistan, and many Tour Operators in all corners of the world which gives an opportunity to expand the range of services and choice of countries for recreation. Our goal is to make your trip highly comfortable, safe, and interesting. "Sky Tour" company is a member of the TATO (Tajik Association of Tour Operators) and is accredited with the Ministry of Foreign Affairs of the Republic of Tajikistan.