Brand new USDA application for the loan and you can recognition procedure also are so much more based up on government entities than other antique financing. As an example, through the an authorities shutdown of a lot prospective homeowners who need USDA money are left sat on the subs bench before the regulators will get back working.

People USDA financing shall be refinanced to help you a conventional (non-government) loan, however the USDA will only re-finance mortgage loans that will be currently USDA money. Refinancing a great USDA mortgage will always lower your rate of interest because of the no less than one percent, and it’s fairly very easy to perform as long as you’re latest on your own agreed home loan repayments. You can refinance often a beneficial USDA protected financing otherwise direct financing using one of many USDA’s three kind of refinancing software:

Rates to have USDA head funds are ready within step three.25 percent. USDA-acknowledged home loan company enterprises dictate the interest prices for guaranteed fund considering current market conditions and just one applicant’s credit history, certainly other variables. However, by the authorities be sure on these fund, interest rates are less than the typical rates getting traditional fund, which is around cuatro per cent.

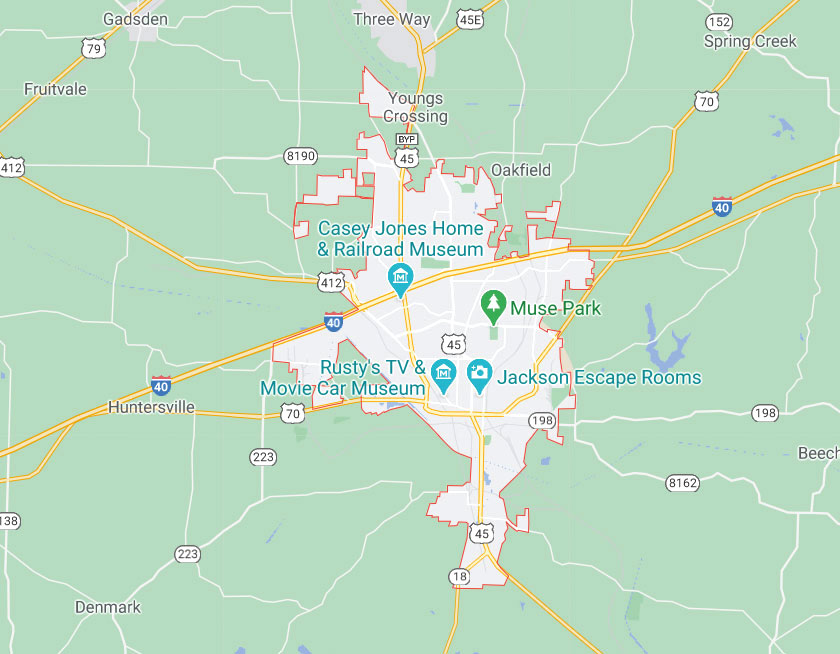

The USDA describes rural of the exemption, and thus any area one does qualify is categorized while the metro/urban are, automatically, classified once the nonmetro/rural. According to the U.S. Company regarding Farming Economic Look Features Classifications, rural otherwise nonmetro areas commonly part of a more impressive work business city and you will routinely have open country side and you can communities fewer than dos,five hundred, regardless of if USDA finance come in parts which have high communities. Brand new map below depicts the limits out of location portion can also be extend beyond a metropolitan center. Here, an excellent rural town is actually any area that isn’t bluish or environmentally friendly.

A USDA mortgage you may buy a different are formulated household, the purchase of your own parcel web site and you will costs associated with transporting the home. The brand new hook would be the fact your own were created house have to have a permanent foundation into possessions to-be qualified, and it will surely become taxed since the a property. Otherwise, a produced house counts as the individual property, and you also is not able to utilize an excellent USDA financing. Like most almost every other assets, a manufactured domestic also needs to end up being inside an eligible outlying otherwise suburban city.

"Sky Tour" company has successfully been working in the tourist market of Tajikistan since February 2011. Despite a relatively short period of activity, the company has thousands of organized trips and satisfied customers. We provide a wide range of tourist services, from excursions around Tajikistan, to round-the-world travel. We organize travel for every taste and depending on the wishes, we select the most ideal variant for the tourist. Managers of the company "Sky Tour" are highly qualified professionals, experts in their work and work execution is impeccable. We track every stage of the journey of our tourists and in the event of unforeseen situations we quickly resolve the issues that have arisen. "Sky Tour" company successfully cooperates with tour companies in all regions of Tajikistan, and many Tour Operators in all corners of the world which gives an opportunity to expand the range of services and choice of countries for recreation. Our goal is to make your trip highly comfortable, safe, and interesting. "Sky Tour" company is a member of the TATO (Tajik Association of Tour Operators) and is accredited with the Ministry of Foreign Affairs of the Republic of Tajikistan.