Brand new Dodd-Honest Wall Road Change and you may User Coverage Work provides personal loan providers powering terrified, with several private-money organizations having ceased originating financing towards private residences altogether. That isn’t required, although not, so long as private loan providers meticulously realize relevant guidelines. The secret to in search of achievement with your loans is based on once you understand the essential difference between new meanings out of an excellent higher-cost home loan and you will an excellent high-costs financial.

A higher-charged real estate loan was a consumer credit exchange secured from the customer’s dominating dwelling which have an annual percentage rate (APR) that exceeds the typical primary offer speed (APOR) by the a given number. 5 percent or higher. Getting a under home loan, financing are higher-priced if the their Apr exceeds the latest APOR by step three.5 percent.

Both the large-charged mortgage and the large-prices home loan are secure from the borrower’s individual house, but the higher-listed financial has only you to significant standard within its definition: the fresh aforementioned Annual percentage rate and you will APOR criteria. Additionally, a premier-costs mortgage has the adopting the about three big standards within its meaning:

The difference between high-pricing and better-cost mortgage loans try not to prevent truth be told there, although not, and private-money loan providers will be smart to guarantee that they have been obvious to your what of them particular loans. This new legislation one apply to high-priced mortgages tend to be less than individuals who connect with highest-prices mortgages. For-instance, in terms of highest-charged mortgages, originators generally must manage around three certain limitations:

Private-currency loan providers is always to read, yet not, one to many almost every other rules must be complied with having a private individual home loan meet up with the definition of a beneficial high-prices mortgage. High-pricing mortgage loans have to meet with the same three conditions one to have to do with higher-cost mortgage loans, but to those, the next conditions pertain, as well as others: no balloon commission is actually allowed; the fresh new collector dont recommend standard; the most acceptance later payment is actually cuatro per cent of the past-owed fee; items and you may costs is almost certainly not funded regarding the mortgage; no loan mod or expansion costs can be billed.

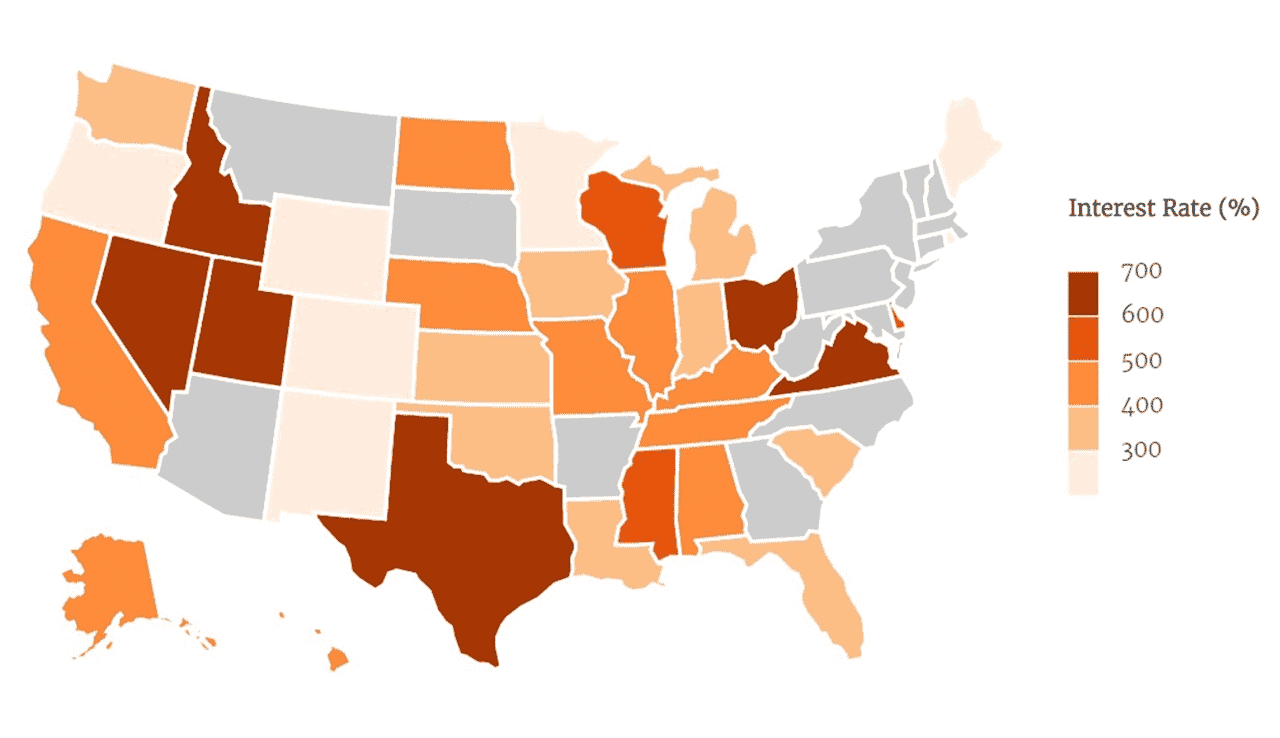

Private-money lenders is nevertheless browse and you may adhere to the latest legislation away from their own states, which are often stricter than simply government rules.

To complicate things, the aforementioned requirements are not the only of them one to connect with high-pricing mortgages. This type of fund might also want to meet with the pursuing the conditions:

When personal loan providers as well as their attorney understand the full selection of restrictions one apply to large-rates mortgages, many of them operate by determining not to romantic any more individual home finance. In the event that a private financial features its individual house financing terms lower than the new thresholds from the definition of a premier-costs financial, but not, then your finance commonly merely be large-valued mort-gages, which means just about three regulations need to be complied that have.

If you go after these guidelines, individual private house fund does not meet the definition of high-cost mortgages, and the majority of the latest relevant bans will not apply. In case your personal financing merely a higher-listed financial, upcoming the terms and conditions about high-listed funds could be enjoy. Private-money lenders is always to still browse and you will adhere to the new statutes out-of their particular says, however, which can be stricter than just federal laws.

Of many private buyers aren’t ready to money a totally amortized loan. Rather, he is comfortable with an excellent four- so you’re able to 7-season balloon percentage on notice. From the originating a higher-valued financial, private-money loan providers can invariably lay an effective balloon payment into the your own household financing. Also, being unable to funds factors and you can charge from inside the a personal quarters home mortgage refinance loan excludes of several residents of bringing urgently expected money, because these consumers often don’t possess sufficient cash to invest items and you may charge out of pocket. From the originating a high-priced mortgage, although not, facts and you may charge might be funded.

Impact all this planned, private-money lenders can be rest assured that fund can nevertheless be done to your private homes as long as they stand in definition out-of a higher-listed home loan. Originating this type of financing normally increase your organization’s profile of goods and you will give you the newest money channels in the process.

"Sky Tour" company has successfully been working in the tourist market of Tajikistan since February 2011. Despite a relatively short period of activity, the company has thousands of organized trips and satisfied customers. We provide a wide range of tourist services, from excursions around Tajikistan, to round-the-world travel. We organize travel for every taste and depending on the wishes, we select the most ideal variant for the tourist. Managers of the company "Sky Tour" are highly qualified professionals, experts in their work and work execution is impeccable. We track every stage of the journey of our tourists and in the event of unforeseen situations we quickly resolve the issues that have arisen. "Sky Tour" company successfully cooperates with tour companies in all regions of Tajikistan, and many Tour Operators in all corners of the world which gives an opportunity to expand the range of services and choice of countries for recreation. Our goal is to make your trip highly comfortable, safe, and interesting. "Sky Tour" company is a member of the TATO (Tajik Association of Tour Operators) and is accredited with the Ministry of Foreign Affairs of the Republic of Tajikistan.