Since the manufacturing within the 1934, the fresh new Government Housing Administration’s purpose could have been to add the means to access mortgage loans getting lower income, first-big date customers and you will minorities to help you encourage homeownership.

Up until the FHA came along, really mortgage individuals had small-name, balloon- or “bullet-payment” mortgages having down money you to definitely averaged regarding fifty percent. If you are home loan prices averaged 6 percent throughout most of the 1920s and you can 1930s, in the event that FHA arrived with fixed interest rates which they place, competition increased, operating down average interest rates nearer to 5 %.

“The brand new FHA become in an effort to assist group during the High Despair by giving enough time-label money having low down commission requirements,” says Raphael Bostic, try president and you can ceo of one’s Federal Set-aside Bank of Atlanta and you will an old secretary of your own You.S. Dept. out of Property and you may Metropolitan Creativity. “Early mortgage products that was in fact readily available through to the FHA was five-season money with a beneficial balloon fee you to definitely necessary (at the least) a 20 percent downpayment. At the conclusion of 5 years residents needed to refinance or sell, and that lead to the huge loss of home to help you foreclosure throughout the the great Depression.”

Today, really FHA borrowers do not know that FHA put the own interest rates up until 1983, if Property and Rural Healing Operate mandated one FHA home loan pricing should be field-created.

“Typically given that 2000, FHA mortgage prices were on 0.125 so you’re able to 0.25 percent more than compliant funds,” says Keith Gumbinger, vice president regarding HSH. “FHA loans possess greater over to own lenders, require special certification and you will come with a whole lot more bureaucracy, for them to cost more to possess loan providers to originate.”

“FHA money disappeared for the subprime financing boom (2004-2007) because people which have a weak borrowing from the bank reputation otherwise deficiencies in bucks may get subprime fund,” states Rick Sharga, Creator & Ceo, CJ Patrick Company during the Trabuco Canyon, California, and you will former professional vice-president from the ATTOM and you may RealtyTrac. “FHA loans enjoyed a resurgence after the subprime market meltdown as the it absolutely was nearly the only real lay one individuals could go. The brand new FHA stopped a deeper disappear the new cliff toward housing marketplace. Without it, indeed there would-have-been a lot more foreclosure.”

In times away from worry otherwise suspicion for the property markets, private-sector mortgage loans may become tough to come across, and even conforming financial areas can see borrowing availableness be curtailed or higher pricey. Its in some instances such as these that FHA system very shows its value.

125 to 0.25 percent originating in 2010 partly from the run out of out of punishment towards FHA financing for having a lower life expectancy credit score or a high loan-to-worthy of, states Gumbinger.

“You to need FHA cost could be below compliant-loan cost would be the fact Federal national mortgage association and you will Freddie Mac have additional ‘loan peak rate adjustments’ and you will verify charge on the fund you to lenders then pass on in order to consumers when it comes to large prices,” claims Bostic.

Had Mel Watt, director of your own Federal Homes Fund Institution, not delayed fee expands towards Federal national mortgage association and you can Freddie Mac loans after 2013, conforming rates will have risen more than it or even do provides, increasing the bequeath anywhere between FHA and conforming and money, demonstrates to you Gumbinger.

However, immediately after numerous years of distorted financial avenues appearing out of the Higher Credit crunch, some thing began to normalize, and FHA-supported mortgage loans once more started to so much more consistently come across rates above people to possess compliant finance. Too, in the event the Federal Reserve are buying huge amounts of MBS out-of Fannie Mae and Freddie Mac, liquidity in this part of the markets is actually significantly improved, which helping conforming costs in order to decline further than performed people to have FHA-backed loans.

Home loan pricing are greater than these are typically in many years, and this has FHA financial pricing. Often pricing to own FHA-recognized financing split high or below their conforming alternatives given that economic rules and you may monetary avenues come back to regular once more? “It’s not obvious in the event that FHA rates commonly constantly will always be above compliant rates, nonetheless they may when the homes money markets will always be unstressed,” states Gumbinger.

Even when FHA rates of interest are affordable, brand new some more expensive out of FHA home loan insurance costs and also the requisite one home loan insurance coverage need to be purchased the life span off a keen FHA financing keeps contributed of several borrowers in order to you better think again FHA money in support of conforming fund.

Many years straight back, “The latest FHA enhanced its mortgage insurance rates standards so you can shore in the cash supplies Congress necessitates the FHA having,” says Bostic. “FHA individuals enjoys an excellent riskier profile so you would definitely think that the loan costs is higher, however the loans Saguache financial insurance coverage requisite offsets the risk and will help remain prices all the way down.”

Eg Federal national mortgage association and you may Freddie Mac, the brand new FHA extended mortgage restrictions to simply help counterbalance a lack of mortgage borrowing access when you look at the construction drama, assisting to continue financial money open to audience away from apparently tight boundaries away from GSE-backed loans. Both borrowers away from small form and those who be a little more better-to-create discover coverage within the FHA-recognized mortgage loans, referring to gonna remain.

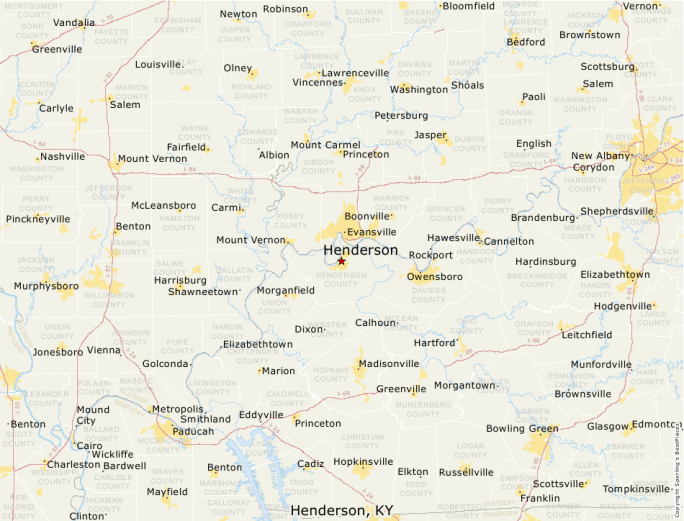

Even after as pricier, these audiences may still become firmly keen on FHA-backed money, says Gumbinger. “Homeowners and you will property owners in the pricey segments who want a good jumbo financial but do not have the 20% deposit (otherwise security stake) that private-field loan providers commonly want may start on the FHA, that may back money all the way to $step one,149,825 in a number of section. The loan insurance rates costs is generally a great detraction, but oftentimes it the only real path having lower-collateral consumers to acquire reasonable money.” You can look up research FHA loan restrictions on the area during the HUD’s site.

"Sky Tour" company has successfully been working in the tourist market of Tajikistan since February 2011. Despite a relatively short period of activity, the company has thousands of organized trips and satisfied customers. We provide a wide range of tourist services, from excursions around Tajikistan, to round-the-world travel. We organize travel for every taste and depending on the wishes, we select the most ideal variant for the tourist. Managers of the company "Sky Tour" are highly qualified professionals, experts in their work and work execution is impeccable. We track every stage of the journey of our tourists and in the event of unforeseen situations we quickly resolve the issues that have arisen. "Sky Tour" company successfully cooperates with tour companies in all regions of Tajikistan, and many Tour Operators in all corners of the world which gives an opportunity to expand the range of services and choice of countries for recreation. Our goal is to make your trip highly comfortable, safe, and interesting. "Sky Tour" company is a member of the TATO (Tajik Association of Tour Operators) and is accredited with the Ministry of Foreign Affairs of the Republic of Tajikistan.