MENUMENU

Our knowledgeable teams normally mention your own property foreclosure along with you which help you explore all options to keep your family.

Our very own experienced professionals can be discuss your foreclosures along with you that assist you speak about all your options to save your house.

If you’re a citizen of your own State of Los angeles, you could apply to the fresh State regarding La Home loan Recovery Program.

Telephone call 211, L.A great. County’s information hotline, to own lower-cost casing and you can shelters, psychological state functions and you will food direction. Call your neighborhood homes power to have details about Part 8 otherwise low-money homes.

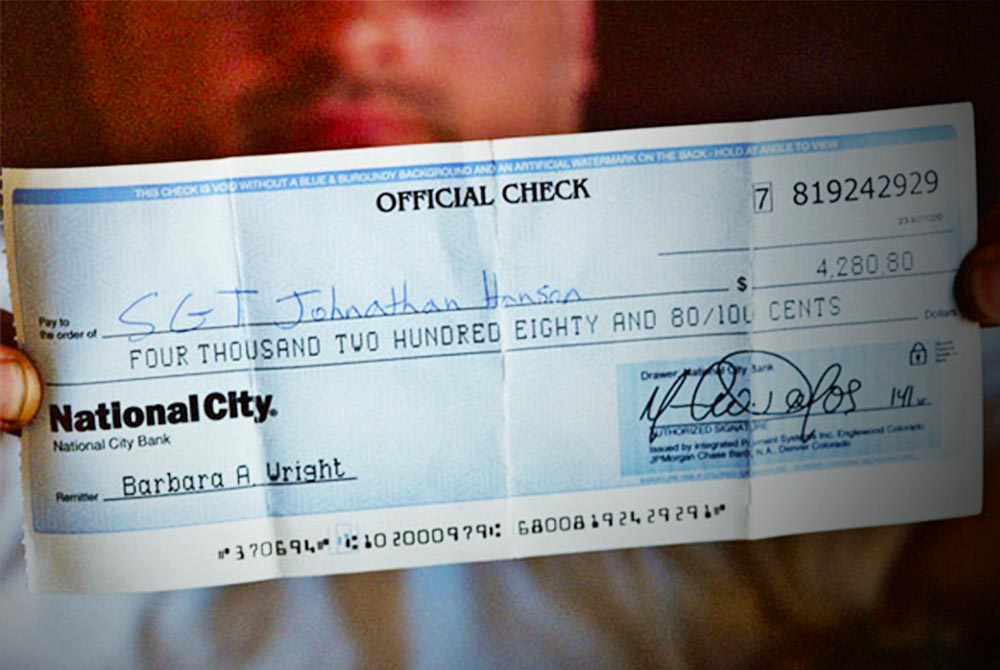

Most people and you can enterprises will guarantee to assist save your valuable home. Very will just bring your money, do nothing and you might remove your residence. Do not become a victim out-of a foreclosure cut ripoff. If you were scammed call us straight away so you can file an issue. All our qualities is free!

Repaired Rates Home mortgage Financing — If you want the protection off never getting your monthly percentage alter, here is the home loan that you’ll choose. The mortgage rate and you will personal loans online New Hampshire fee is actually fixed into the longevity of the loan , whether the mortgage is actually ten, fifteen, 31 otherwise forty years. Which have newest low rates to your repaired rate home mortgages, this is certainly a perfect solution for almost all borrowers off financial inside La. Whenever cost are large, they sometimes is practical to make use of a changeable price in hopes out-of decreasing coming appeal costs.

FHA Home loan Loans — FHA home loans are funds covered by the Federal Houses Management. Normally, FHA home loan pricing in Los angeles are below comparable traditional mortgages. FHA supported mortgage money give advantages such as down money as low as 3.5% , convenient qualification direction, and easier usage of loan providers, especially in tough home loan -ten.

Cash out Mortgage Loans — If you would like otherwise should make a substantial pick or money, with your residence’s collateral can be the least expensive alternative. Whether to possess college costs, unexpected medical expenditures, the break regarding a lifetime, or a-room inclusion, you might refinance your home home mortgage to obtain cash to possess these aim. You may find it less expensive to make use of a home Security Line of credit (HELOC), a traditional second trust deed, or refinance the original trust deed. We are able to help you with that decision.

Debt consolidation Mortgage Money — You happen to be expenses quite high attention for the automobile, private traces, second trust deeds, credit cards or other investment. People interest rate you are investing a lot more than eight otherwise 8% is actually significantly more than what you would getting investing using a great home loan within the Los angeles. Refinancing your house home loan to help you combine other financial obligation lower than one to low mortgage price can save you currency and lower your month-to-month repayments. Desire for the lenders is tax deductible. A supplementary preserving (or, effectively a much deeper rates cures) you don’t get with playing cards, car rentals and so on.

Changeable Speed Home mortgage Funds — In certain locations this may seem sensible to reduce the month-to-month mortgage loan payment during the early numerous years of your financial. Home loan rates getting Possession are usually low in early years than traditional fixed rate programs. This can be particularly so if you plan on offering otherwise refinancing your property within just 10 years. Although not, certain varying rates home loan money inside Los angeles do not amortize fully otherwise ortization. This is why you are not enhancing the collateral in your family as quickly as you would for the a normal mortgage. For individuals who protect an increase for many years simply, your exposure rates growing which in turn could result in their monthly obligations increasing.

"Sky Tour" company has successfully been working in the tourist market of Tajikistan since February 2011. Despite a relatively short period of activity, the company has thousands of organized trips and satisfied customers. We provide a wide range of tourist services, from excursions around Tajikistan, to round-the-world travel. We organize travel for every taste and depending on the wishes, we select the most ideal variant for the tourist. Managers of the company "Sky Tour" are highly qualified professionals, experts in their work and work execution is impeccable. We track every stage of the journey of our tourists and in the event of unforeseen situations we quickly resolve the issues that have arisen. "Sky Tour" company successfully cooperates with tour companies in all regions of Tajikistan, and many Tour Operators in all corners of the world which gives an opportunity to expand the range of services and choice of countries for recreation. Our goal is to make your trip highly comfortable, safe, and interesting. "Sky Tour" company is a member of the TATO (Tajik Association of Tour Operators) and is accredited with the Ministry of Foreign Affairs of the Republic of Tajikistan.