MENUMENU

While the rates towards much time-term mortgages always rise, to find property within the current list-large pricing is problems. not, a recent study away from Zillow learned that there is some thing homebuyers is going to do to store themselves big time if this comes to mortgage loans: boost their credit ratings.

That is you to actionable topic people will do to store a little bit of profit it anda Pendleton, individual loans specialist at the Zillow Home loans within the a job interview which have CNBC.

For the reason that lenders fool around with fico scores in order to determine how probably it is you to definitely a borrower tend to pay off brand new mortgage. That isn’t the only real grounds, although it does enjoy an enormous part into the not merely choosing if a title loans in North Dakota buyer often qualify for home financing, in addition to what sort of rate of interest they shall be provided.

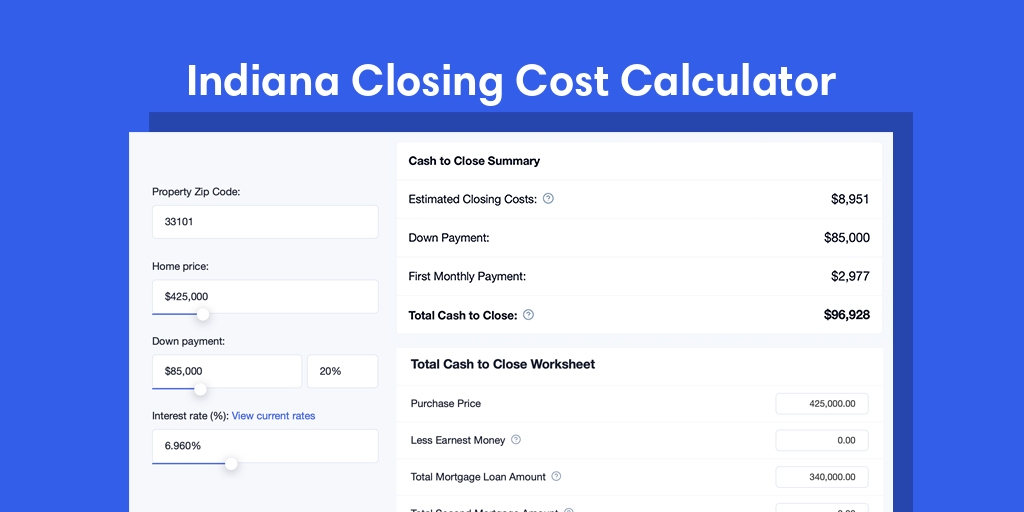

Brand new Zillow studies stated that based on the average U.S. house speed now — $354,165 — homebuyers having straight down credit scores pays as much as $103,626 also the category away from a 30-year repaired mortgage than a different customer which have advanced borrowing from the bank.

That works over to in the $288 so much more thirty days of these with fair credit ratings, or the individuals ranging from 620 and 639, as opposed to those with ratings considered higher level, ranging from 760 and 850.

In addition to distinction comes from all of the interest levels the individuals borrowers receive. Such as for instance, if you find yourself someone with advanced credit has been offered a performance of 5.099% inside towards a 30-12 months repaired mortgage, a debtor with only fair borrowing might be recharged 6.688% at that same day and age, based on Zillow’s studies.

Fico scores derive from five very first situations. First and more than important is the payment history. Do you have a beneficial history of paying your own costs promptly? Each later percentage often ding your credit score.

Next foundation is how much debt you owe relative to your own offered borrowing. While maxing your credit card limitations, it seems like you might be in the a desperate monetary state and at risk for dropping at the rear of to the costs.

Third, the length of your credit history facilitate influence your own score. The latest stretched your time having fun with borrowing from the bank, more studies the financing bureaus want to get a precise picture of your creditworthiness.

The newest last credit factor is the sort of credit accounts your supply. Cost financing for example car and you can beginner personal debt tend to force their score highest when using a lot of revolving financing instance handmade cards is straight down it.

Last but not least, the very last grounds is when much the brand new borrowing from the bank you have taken out recently. One credit issues remain on their statement getting between several and you will eighteen months. If you find yourself usually finding the fresh personal lines of credit, it does feel like you’re not handling your finances well.

You can begin from the examining your credit history, that you’ll carry out free of charge with every of your around three biggest credit rating bureaus. Start by selecting any mistakes and you may alert the fresh bureaus immediately to improve them. This might provide your own score an easy boost.

If you have been missing money or dropping about, you can observe a good uptick in your get for those who specialize in spending everything you purely on time for another half dozen months. Whenever you can have the ability to pay down your financial situation throughout that same for you personally to 30% or a reduced amount of your borrowing from the bank restrictions, you will pick a score update. And you will obviously refrain from applying for one brand new finance for a few weeks prior to purchasing property if not due to the fact home loan techniques begins. Hold off into to acquire one the newest chairs otherwise the fresh vehicles up until the loan closes.

While boosting your credit history takes a while, it does extremely pay-off in terms of saving money in your second house get.

Please give us a call today to see what the commission was if you were to purchase otherwise refinance your house.

"Sky Tour" company has successfully been working in the tourist market of Tajikistan since February 2011. Despite a relatively short period of activity, the company has thousands of organized trips and satisfied customers. We provide a wide range of tourist services, from excursions around Tajikistan, to round-the-world travel. We organize travel for every taste and depending on the wishes, we select the most ideal variant for the tourist. Managers of the company "Sky Tour" are highly qualified professionals, experts in their work and work execution is impeccable. We track every stage of the journey of our tourists and in the event of unforeseen situations we quickly resolve the issues that have arisen. "Sky Tour" company successfully cooperates with tour companies in all regions of Tajikistan, and many Tour Operators in all corners of the world which gives an opportunity to expand the range of services and choice of countries for recreation. Our goal is to make your trip highly comfortable, safe, and interesting. "Sky Tour" company is a member of the TATO (Tajik Association of Tour Operators) and is accredited with the Ministry of Foreign Affairs of the Republic of Tajikistan.