If or not to acquire another type of otherwise car, many people don’t want to get a motor vehicle downright. If this sounds like you, then you’ll have to secure an auto loan. However, dependent on your existing finances, certain loan providers can get think twice to give you recognition.

Should you decide sign up for a car loan, the lending company is just about to check your credit history. If you have produced particular monetary missteps prior to now and possess poor credit, this could lead an assertion.

A couple of problems that create major ruin, actually to an effective credit score, is defaulting into the that loan and declaring case of bankruptcy. If you defaulted toward a past auto loan and had the latest car repossessed, it gets much more difficult to get acknowledged for another vehicle loan.

Other secrets in terms of your credit rating try your payment record and you can borrowing utilization. Your own commission history will suffer if not create your minimal statement payments on time, specifically if you are not able to build a charge card payment. The borrowing use endures for individuals who continuously use more than 30 per cent of one’s readily available credit.

None ones situations commonly reduce your credit history instantly, however if a bad percentage records and you can higher borrowing use be a routine procedure, your borrowing will suffer.

Your credit score was an indication of your own creditworthiness. For individuals who have not dependent people credit score, its nearly because challenging once the with a less than perfect credit get.

For individuals who have not gotten any money or handmade cards regarding past, then you definitely e. Loan providers could well be wary about issuing you an auto loan due to the fact you’ve not confirmed to be top to pay back the money you acquire.

Thank goodness that it’s easier to present credit than just its to fix it. By acquiring, using and you can vigilantly repaying a credit card, you are able to quickly boost your credit history.

Perhaps you have a good credit score, however you dont make enough money to repay your car financing. Inside circumstances, the car lender get like to not accept the loan americash loans Camden.

Just what loan providers generally speaking consider is both the monthly income and you will your debt-to-earnings ratio. With your monthly earnings, they examine the amount you will be making having how much cash your vehicle loan fee would be. For the debt-to-money proportion, they appear at exactly how much you’ve got indebted repayments for each few days compared to the how much you will be making.

This type of issues aren’t a way of measuring though you happen to be a high earner. When you’re a minimal earner that have couples expenditures and you may low debt, you can nonetheless receive acceptance into a car loan. On top of that, while you are a premier earner however you currently have quite an effective couples costs to spend, a lender you’ll refute the job.

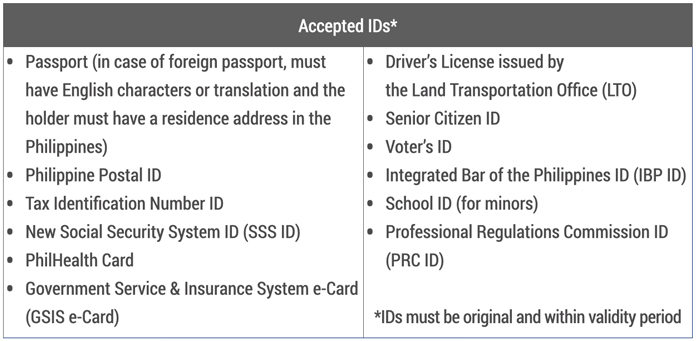

Among trusted activities to eliminate is actually neglecting to incorporate the mandatory files with your loan application. You may have to were duplicates away from spend stubs since the evidence cash, their driver’s license and other data files when you submit an application for an effective financing.

More people score declined for it than you may envision, and it’s best if you verify that you’ve integrated that which you before you could turn in the job.

During the Bryant Vehicles, we all know exactly how difficult it may be locate vehicles resource, and you will our very own goal is always to help visitors in order to score an auto loan. We are able to help you safer a car loan even though you haven’t situated the credit yet , or you has actually poor credit.

"Sky Tour" company has successfully been working in the tourist market of Tajikistan since February 2011. Despite a relatively short period of activity, the company has thousands of organized trips and satisfied customers. We provide a wide range of tourist services, from excursions around Tajikistan, to round-the-world travel. We organize travel for every taste and depending on the wishes, we select the most ideal variant for the tourist. Managers of the company "Sky Tour" are highly qualified professionals, experts in their work and work execution is impeccable. We track every stage of the journey of our tourists and in the event of unforeseen situations we quickly resolve the issues that have arisen. "Sky Tour" company successfully cooperates with tour companies in all regions of Tajikistan, and many Tour Operators in all corners of the world which gives an opportunity to expand the range of services and choice of countries for recreation. Our goal is to make your trip highly comfortable, safe, and interesting. "Sky Tour" company is a member of the TATO (Tajik Association of Tour Operators) and is accredited with the Ministry of Foreign Affairs of the Republic of Tajikistan.